Concur Travel Card Policies Procedures

Revised Sept 2022

TABLE OF CONTENTS

- Section I: GENERAL INFORMATION

- Section II: APPLYING FOR A CONCURTRAVEL CARD

- Section III: USING THE CONCURTRAVEL CARD

- Section IV: RESPONSIBILITIES

- Section V: PROCEDURES

- Section IV: REFERENCES

Section I: GENERAL INFORMATION

The Concur Travel Card is the primary payment option for Cal Poly business travel; travelers are strongly encouraged to utilize this card system as a first payment option. It is a corporate liability card that is an integrated feature of the Concur travel platform (Cal Poly’s travel management system)

The Concur Travel Card offers a quick and reliable way to pay for travel and offers the same conveniences as a personal credit card. It eliminates the need to pay for travel personally and then seek reimbursement. If you have a Concur Travel Card, it should bethe primary form of payment for travel expenses.

The Concur Travel Card is not intended to avoid or circumvent applicable travel policies and procedures. It is the responsibility of the individual spending funds on official University business travel and the approving official approving the use of such funds to be aware of and follow the policies and procedures in effect at the time of travel.

A Concur Travel Card is a privilege that can be revoked in cases of non-compliance to policies and procedures.

CSU Travel Policy can be found at: https://afd.calpoly.edu/travel/policy/

It is expected that individuals traveling on official University business will take all steps to minimize risk to themselves and the University. This includes utilizing safe transportation and lodging options and acquiring appropriate insurance coverage when necessary.

Section II: APPLYING FOR A CONCUR TRAVEL CARD

-

Select an Approving Official.

An Approving Official is defined as an employee with a classification of MPP, Department Head, Department Chair or Confidential Employee. An Approving Official will review and authorize the cardholder’s travel charges each month and should be at least one level above the cardholder. A cardholder cannot approve their own charges.

An Approving Official for a Department Concur Travel Card cannot be the same person as the Department Credit Card Administrator. This separation of duties is necessary for fiscal accountability.

-

Determine a Monthly Spending Limit.

The cardholder’s Approving Official and/or Department Budget Analyst will help determine the monthly spending limit for a cardholder.The monthly spending limit should be set to accommodate travel needs.

-

Complete an Application and have it signed by the cardholder and Approving Official.

-

Training.

A newly requested Concur Travel Card will arrive at Strategic Business Services office. The Credit Card Program Administrator will then contact the cardholder regarding training. A training session is mandatory for all cardholders,and must occur before the card is released to the cardholder. The cardholder must sign the Cardholder’s Agreement.

Existing cardholders will be required to retrain annually.

-

Activation.

The card will decline if it is not activated prior to use. To activate the Concur Travel Card, call the US Bank customer service number (800) 344-5696. If calling from a campus phone, after the system answers press 9 to activate the tone sender.

- Enter 16-digit US Bank credit card account number.

- Enter Cal Poly’s zip code 93407.

- Press “1”.

- Enter the last four (4) digits of Cal Poly’s generic social security number, “9999”.

- Enter business phone number provided upon application.

- Press “1”.

- Sign the back of your card.

Section III: USING THE CONCUR TRAVELCARD

How to Use the Concur Travel Card

-

Activate your card.

-

Complete a Travel Request in Concur before you travel.

-

Follow CSU Travel Policy for all charges to the card.

-

Keep all receipts, whether the purchase is made by phone, in person, or online.

-

Review charges in Concur and move to appropriate Expense Report.

-

Fill out an Expense Report within 30 days of the end of a trip, and upload/attach the proper receipts.

-

Include a Hospitality Form in the Expense Report, if incurring hospitality expenses (which are allowed on the Concur Travel Card) while on travel.

- Submit Expense Report and all backup documentation as required in Concur.

Prohibited Uses of the Concur Travel Card

The following are prohibited…

-

Expenses not related to Cal Poly approved business travel.

-

Personal Purchases. The Concur Travel Card is only for allowable University purchases, therefore all unapproved charges incurred with the Concur Travel Card may be deducted from your travel claim (via a submitted Expense Report) or may require reimbursement to the University through the Cashiers Office. If excessive instances of personal purchases occur, your card may be revoked for misuse.

-

Alcoholic Beverages for personal consumption (exception: fundraising activities charged to a fund that allows alcoholic beverages).

-

Cash Advances/Traveler’s Checks.

The University assumes no financial responsibility for expenditures incurred by individuals who fail to adhere to policy.

Section IV: RESPONSIBILITIES

Cardholders and Department Credit Card Administrators are responsible for ensuring the Concur Travel Card is used in accordance with the policies outlined in this manual and that all charges are in compliance with CSU Travel Policy.

Responsibilities of the Cardholder

-

Completing mandatory training (or retraining, if deemed necessary by the Credit Card Program Administrator) and signing Cardholder’s Agreement before Concur Travel Card is issued.

-

Registering the card on the US Bank website and closely monitoring spending limits, transactions and balance.

-

Security of the Concur Travel Card. If kept in a personal office, it should be stored out of sight, and preferably in a location that can be locked when not in use.

-

Appropriate use and compliance with the Cal Poly Concur Travel Card Policies and Procedures and the CSU Travel Policy.

-

Collection of all required documentation of purchases. See Section VI:Procedures: Documentation of Purchases.

-

Claiming travel expenses via an Expense Report in Concur.

-

Filling out a Travel Card Revision Form if changes need to be made to the cardholder’s information originally provided in the Application form.

-

Reporting fraud to the US Bank and disputing charges.

Responsibilities of the Approving Official

-

Reviewing all transactions and certifying they are all appropriate bona fide business expenses and are made in accordance with the policy.

-

Ensuring adequate transaction documentation exists specified in the Concur Travel Card Policies and Procedures (such as HospitalityForms and receipts when required).

-

Identifying possible violations of assigned cardholder(s) and taking appropriate action if violations are found. In cases of violations, the Credit Card Program Administrator must be notified.

-

Notifying the Credit Card Program Administrator when their assigned employee no longer has a Concur Travel Card, has left the University, or changed departments.

-

Prior to any absences, the Approving Official must delegate their approving authority via their profile in the Concur tool, regardless of the Approving Official’s personal schedule or sick leave. See Concur Profile guideline for directions on how to do this.

-

Ensuring the Travel Card has not been used for prohibited purchases.

-

The charges as shown in Concur have the correct chart of accounts, all receipts and supporting documentation are attached to the Expense Reports.

Note: Cardholder will receive email notifications for outstanding charges until the charges are moved to an Expense Report, but the report does not have to be submitted in order to eliminate email notifications.

Approving Officials may be required to retrain, and/or the cards of their subordinates blocked if the established policies and procedures are not followed.

Section V: PROCEDURES

Documentation of Purchases

Documentation of purchases is required regardless of whether the purchases were made in person, over the phone, online, or by any other means. The Cardholder must have an itemized receipt with:

-

Description of purchases

-

Name of vendor

-

Price

-

Amount of sales tax

-

Total amount

All hospitality charges require a completed Hospitality Form to be submitted. All additional documentation must be attached to the Expense Reports and submitted to Payment Services within 30 days after completion of travel.

If receipts are lost, and duplicate copies cannot be obtained from the vendor, the cardholder is responsible for filling out a Missing Receipt Affidavit in Concur or a Lost Receipt Form for the transactions missing documentation.

Registering Your Card on US BankWebsite

Becoming a registered user on the US Bank website will allow you to:

-

View your previous and pending transactions

-

View the monthly credit limit

-

View your available credit and account balance

-

View your statements

-

Dispute charges

If you need help navigating the US Bank website or you forgot your user ID or password, call Access Online Support line (877) 887-9260.

HOW TO REGISTER YOUR TRAVEL CARD WITH US BANK:

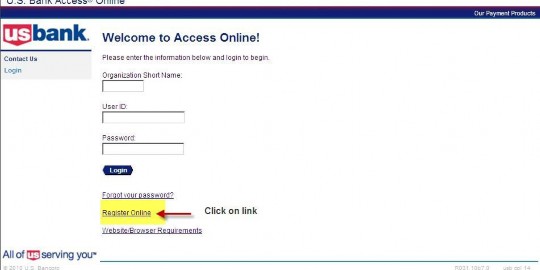

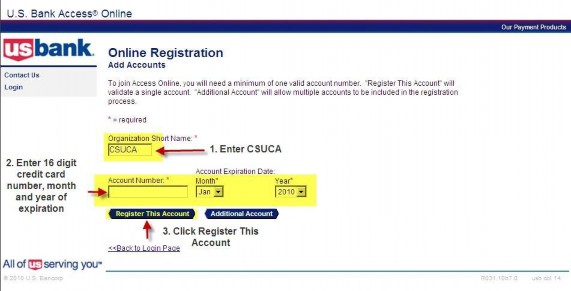

Go to access.usbank.com and click on the “Register Online” link.

-

In “Organization Short Name” field enter CSUCA.

-

In “Account Number” field enter 16 digit credit card number. Indicate month and year of expiration.

-

Click on “Register This Account”.

-

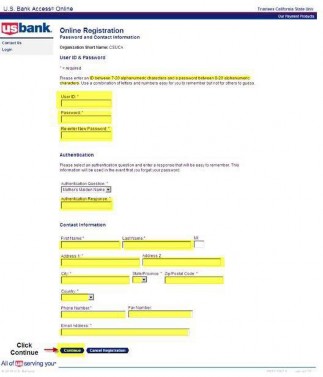

Scroll down. Click on “I Accept”.

-

Complete all the fields with the asterisk symbol “*”. Click Continue.

Concur Travel Card Violations and Correction Procedures

Any misuse of the ConcurTravelCard as outlined in this Concur Travel Card Policies and Procedures, or failure to follow the established protocol of timely submission of documentation are considered violations.

If a cardholder incurs three (3) violations within a fiscal year, they will have their Concur Travel Card temporarily deactivated until retraining takes place. Departments are encouraged to develop internal policies and protocol to ensure violations do not occur.

Concur Travel Card Violations include, but not limited to:

-

Missing receipts

-

Non-itemized receipts

-

Personal purchases

-

Missing Signatures

-

Missing Hospitality Form

-

Unauthorized Transactions

-

Misuse of Concur Expense Types (Ex: Using “Other Expense” to circumvent $68 meal allowance limit)

Corrective Actions for Violations:

-

First Offense: Email to Cardholder and Approving Official with 1 week to remedy the violation

-

Second Offense: Email to Cardholder and Approving Official, warning of card suspension

-

Third Offense: Email to Cardholder, Approving Official and Department VP or Dean. Card suspended for at least 1 billing cycle and retraining required.

Reporting Fraud and Disputing Charges

Fraud

If there are fraudulent charges on your Concur Travel Card, call the Fraud Prevention line at US Bank(800) 523-9078. Be ready to verify your identity. Cardholder may be asked a security question selected upon registration or to verify the following information:

-

Cardholder’s address (answer: 1 Grand Ave, Procurement Services, San Luis Obispo, 93407)

-

Cardholder’s phone number (answer: cardholder’s office phone number)

-

Cardholder’s social security number (answer: 999-999-9999)

-

Cardholder’s credit limit (answer: monthly credit limit on the card)

A new card will be issued by US Bank. Replacement cards will be mailed to the

Procurement Services office. The Credit Card Program Administrator will notify the cardholder when card is ready to be picked up.

If a charge is fraudulent,write“Fraud” in the description field for the appropriate charge on the monthly statement in PeopleSoft.

Disputing A Charge

Card holders an dDepartment Credit Card Administrators are responsible for contacting US Bank Customer Service at (800) 344-5696 about questionable or disputed items no later than 60 days after the transaction appears on the statement. Cardholder will be asked to complete a Dispute Form. Once the dispute has been resolved, US Bank will notify the cardholder.

If an item is billed incorrectly, please write“Disputed” in the description field for the appropriate charge the month statement in PeopleSoft.

Lost or Stolen Cards

Report a lost or stolen Concur Travel Card immediately by contacting US Bank Customer Service at (800) 344-5696 and also notifying the Credit Card Program Administrator.

When a card is reported lost or stolen, a new card will be issued and mailed to the Procurement Services office. The Credit Card Program Administrator will notify the cardholder when a replacement card is ready to be picked up.

Revising Card Account Information

If any of the information provided in the Application Form changes,the Revision Request Form must be filled out and sent to the Credit Card Program Administrator.

Separation from Campus

Approving official must notify Poly Travel upon employee’s separation from University. Account will be closed upon receipt of notice.

All employees must complete expense reports and return their Concur Travel Card before separating from the University

Any outstanding expenses after an employee leaves the University is the departments responsibility; the department will have to submit an expense report on behalf of the departing employee

Terminating Concur Travel Card Account

If a card holder leaves the University, or wishes to cancel their Concur Travel Card,they must return their Concur Travel Card to the Poly Travel Office or safely shred, and notify the Poly Travel Office.

Section IV: REFERENCES

|

ProCard website (forms, tutorials and other resources) |

|

|

US Bank 24-Hour Customer Service |

(800) 344-5696 |

|

US Bank Fraud Prevention Line |

(800) 523-9078 |

|

US Bank Access Online Customer Support |

(877) 887-9260 |

|

US Bank website (view current balance, current and past transactions, credit limit, dispute a transaction) |

|

|

Credit Card Program Administrator |

Stephanie Albright 6-1717 albright@calpoly.edu polytravel@calpoly.edu Administration Bldg. 1, Room 128 |

|

Procurement Specialists and Payment Services Technicians assigned to Departments |