Section I: GENERAL INFORMATION

What is a ProCard?

The Procurement Credit Card (ProCard) is a tool for faculty, staff, and departments to make purchases of goods or services on behalf of the University for which Cal Poly is financially liable. Procurement Services is the only department on campus that was delegated the authority from the Chancellor’s Office to procure goods and services on behalf of Cal Poly. In turn, this authority is delegated to various departments, faculty, and staff within specified spending limits. This delegation of authority comes with the responsibility for departments to observe all University policies and procedures related to purchases, and to observe all laws and regulations (state and federal) that apply to the commercial transactions placed via a ProCard.

ProCard is designed specifically for low value and low volume purchases in order to achieve cost savings and improve processing time. A ProCard is a privilege that can be revoked in cases of non-compliance to established policies and procedures.

Types of ProCards

There are two types of ProCard: an Individual ProCard and a Department Card issued to a department and assigned to a Card Administrator. The policies and procedures are the same for both types of ProCards, unless specifically noted.

INDIVIDUAL PROCARD

An Individual ProCard is issued to an employee in their name. This card can be used to make purchases of low value, low volume, and off-campus services in accordance with this Policy Manual.

DEPARTMENT CARD

This card is issued in the name of a department and can be assigned up to two Department Card Administrators, who are responsible for the use of the card. This type of ProCard should be requested if the need arises for multiple employees to use the card.

Cardholder Eligibility Requirement

ProCards are granted to full-time university employees and both long-term and temporary University employees with a position appointment of at least six months.

The following are not eligible for the Cal Poly ProCard:

- Short-term employees (under 6 months)

- Retired faculty/staff

- Volunteers

- Student assistants

- Auxiliary employees

- Emergency hires

Section V: PROCEDURES

Documentation of Purchases

Documentation of purchases is required regardless of whether the purchases were made in person, over the phone, online or by any other means. The cardholder must have an itemized receipt, which consists of the following:

- Description of commodities purchased

- Name of vendor

- Quantity purchased

- Price per item

- Amount of sales tax

- Shipping charges, if applicable

- Total amount

All purchases require a business justification, while certain purchases require pre-approval, and/or issuance of a waiver. Add this type of information in the free text field on the satement next to each transaction. All hospitality charges require a Hospitality Justification Form to be filled out. All additional documentation must be attached to the monthly statements and submitted to Payments Services at sbs-payment@calpoly.edu before the submission due date. For the list of purchases requiring additional documentation refer to Section III: Uses of the ProCard: Purchases requiring additional documentation and/or Pre-approval.

If receipts are lost, and duplicate copies cannot be obtained from the vendor, the cardholder is responsible for filling out a Lost Receipt Form for the transactions missing documentation.

Monthly Reconciliation Process in PeopleSoft

The billing cycle closes on the 15th of the month. The following day, unless it falls on the weekend, ProCard transactions will be loaded into PeopleSoft Financials – CSU ProCard Module. Cardholders have until the day before month end to reconcile in PeopleSoft Financials. After the due date, no changes can be made to a statement, and the chart field cannot be updated. Past statements can be reviewed in PeopleSoft Financials Completed Inquiry.

A reminder will be sent via email to reconcile your statement. Cardholders have until the 7th of the next month to submit their statement package.

For reconciliation and submission dates refer to the ProCard Calendar.

Missing statements (not turned in on time) will result in immediate card suspension.

Note: The cardholders should make arrangements for someone in their department to complete the reconciliation process if the cardholder is out of the office during the reconciliation period. The Approving Official should provide written delegation of authority to sign on their behalf during their absence. This delegation letter must be included with your monthly statement.

HOW TO RECONCILE YOUR PROCARD STATEMENT

Effective June 2025, a new monthly statement submission process is in place using a PowerForm.

For detailed instructions on the reconciliation process, including how to use the new PowerForm, click here.

Registering Your Card on US Bank Website

Becoming a registered user on the US Bank website will allow you to:

- View your previous and pending transactions

- View the monthly credit limit

- View your available credit and account balance

- View your statements

- Dispute charges

If you need help navigating the US Bank website or you forgot your user ID or password, call Access Online Support line (877) 887-9260.

HOW TO REGISTER YOUR CARD WITH US BANK:

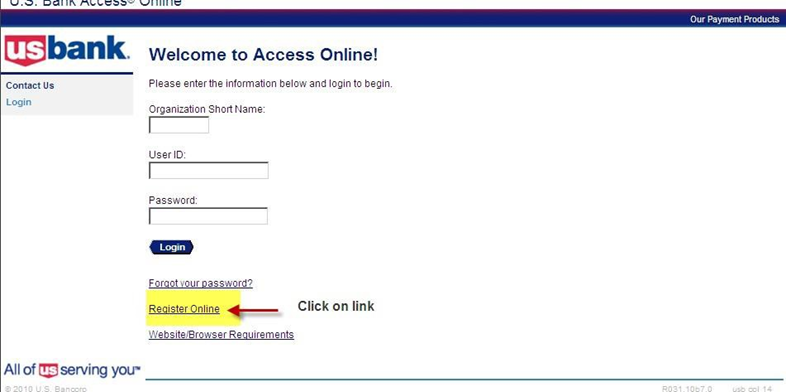

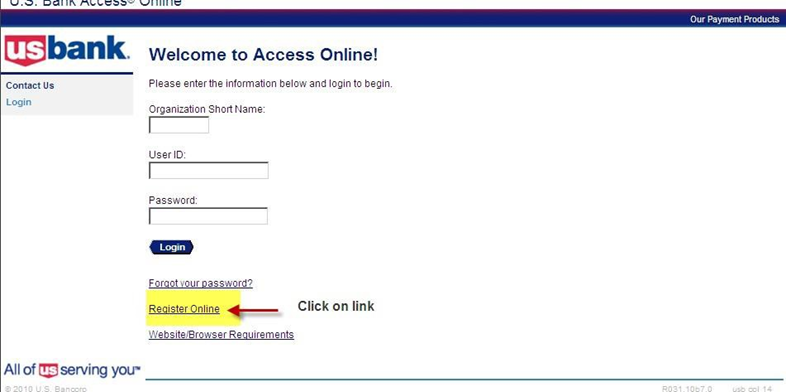

- Go to access.usbank.com and click on the “Register Online” link.

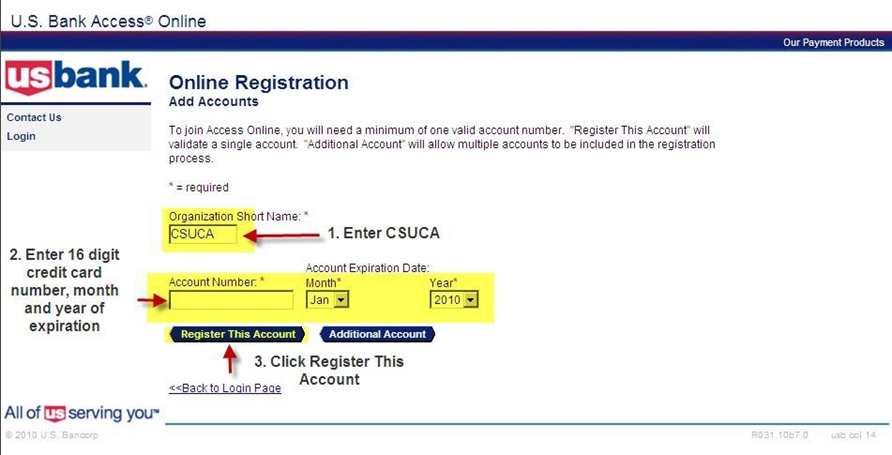

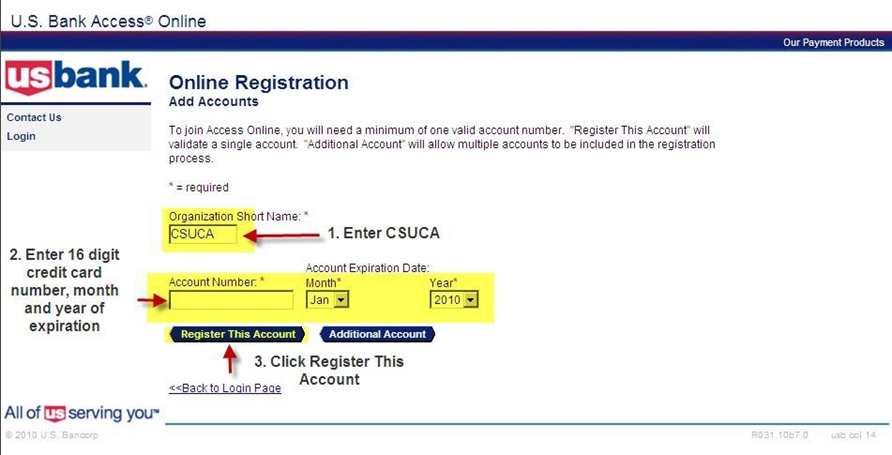

- In “Organization Short Name” field enter CSUCA.

- In “Account Number” field enter 16 digit credit card number. Indicate month and year of expiration.

- Click on “Register This Account”.

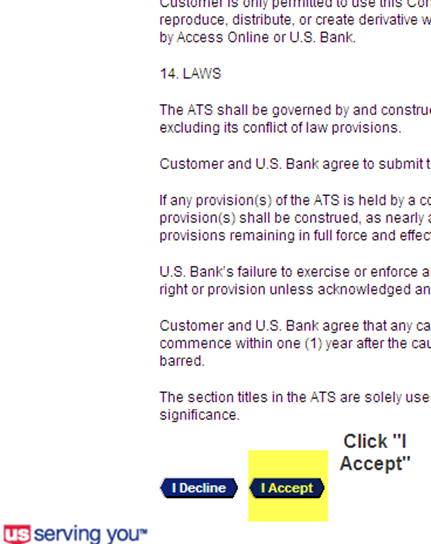

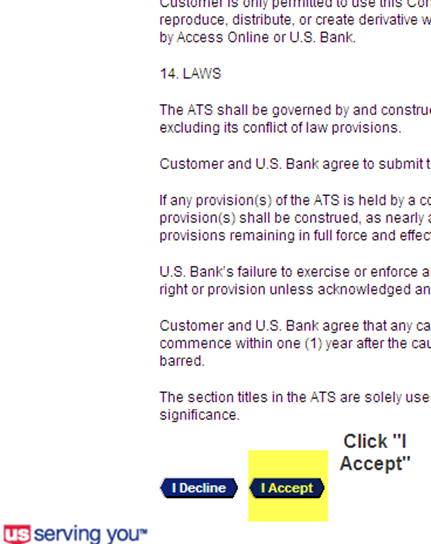

- Scroll down. Click on “I Accept”.

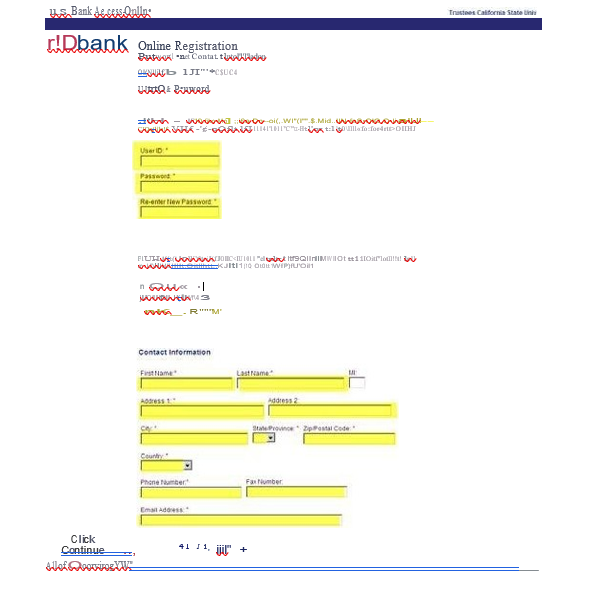

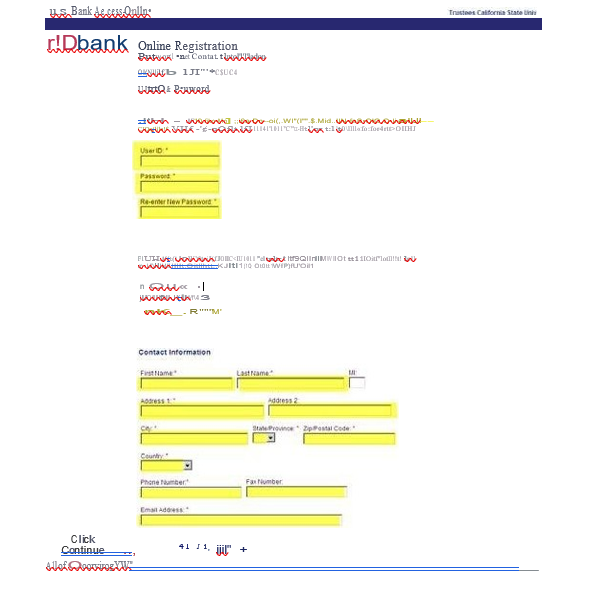

- Complete all the fields with the asterisk symbol “*”. Click Continue.

ProCard Infractions and Correction Procedures

- Unauthorized transactions on any Cal Poly credit card may be deemed a infraction

- In addition to reimbursing the University, a written warning will be issued for infraction

- Continual infraction of any part of the policy shall result in the revocation of credit card privileges, and card cancellation

Any misuse of the ProCard as outlined in this ProCard Policy and Procedures, or failure to follow the established protocol, including tardy submission of documentation of purchases is considered an infraction.

A written warning will be issued for any infractions. Departments are encouraged to develop internal policies and protocol to ensure infractions do not occur.

ProCard Infractions include, but not limited to:

- Missing Statements (card may be suspended immediately)

- Agreements

- Cellular service

- Conflict of Interest

- Drones

- Fines and Late Fees

- Firearms

- Fuel

- Incorrect Approving Official without delegation of authority

- Missing Cashier's Reciept - proof paid back University

- Missing Description and/or Justificaiton

- Missing Furniture Waiver (approved CSUBUY requisition number)

- Missing Hospitality Form

- Missing List of Attendees

- Missing Receipts for Purchase or Credit

- Missing Signatures

- Missing Software Waiver (approved CSUBUY requisition number)

- Non-itemized Receipts

- No Pre-Approval for Gift Cards

- Peer-to-Peer Payment Systems - Paypal, Venmo, Apple Pay, etc.

- Personal Memberships - Amazon Prime, Costco, and the like

- Personal Purchases

- Physical Assets valued $5K+ (or approved single purchase limit)

- Reciepts and back up not in order

- Sensitive Items (desirable, high theft)

- Services/ labor on campus

- Shipping Items Off-Campus

- Split transactions

- Travel

- Unauthorized Transactions

- Unauthorized User

- Vehicles

Corrective Actions for:

- Missing Statements: Immediate card suspension

- First Warning - Infractions: Email to cardholder and Approving Official with 1 week to remedy the Infraction.

- Second Warning - Infractions: Email to cardholder and Approving Official. Warning of card suspension.

- Third Warning - Infractions: Email to cardholder, Approving Official, and VP or Dean. Card suspension for at least 1 billing cycle and retraining required.

Reporting Fraud and Disputing Charges

FRAUD

If there are fraudulent charges on your ProCard, call the Fraud Prevention line at US Bank (800) 523-9078. Be ready to verify your identity. Cardholder may be asked a security question selected upon registration or to verify the following information:

- Cardholder’s address

- Cardholder’s phone number

- Cardholder’s social security number

- Cardholder’s credit limit

A new card will be issued. Replacement cards will be mailed to Procurement Services office. The ProCard Program Administrator will notify the cardholder when card is ready to be picked up.

If a charge is fraudulent, please write “Fraud” in the description field for the appropriate charge the month statement in PeopleSoft.

DISPUTING A CHARGE

Cardholders and Department Card Administrators are responsible for contacting the US Bank Customer Service about questionable or disputed items, which appear as a transaction on the bank statement within 60 days after the date of the bank statement

If an item is billed incorrectly, please write “Disputed” in the description field for the appropriate charge the month statement in PeopleSoft.

If items purchased with the ProCard are received defective, it is cardholder responsibility to return the item(s) to the merchant for replacement or to receive a credit on the purchase. If the merchant refuses to replace the defective item, then the purchase of this item will be considered “disputed” and US Bank must be notified. Cardholder will be asked to complete the Dispute Form. Once the dispute has been resolved, US Bank will notify the cardholder.

Lost or Stolen Cards

Report a lost or stolen ProCard immediately by contacting customer service at the US Bank at 1-800-344-5696 and notify the ProCard Program Administrator.

When a card is reported lost or stolen, a new card will be issued. Replacement cards will be mailed to Procurement Services. The ProCard Program Administrator will notify the cardholder when a replacement card is ready to be picked up.

Revising Card Account Information

If any of the information provided in the Application Form changes, the Revision Request Form must be filled out and sent to the ProCard Program Administrator.

Terminating ProCard Account

If a cardholder leaves the University, or wishes to terminate his/her ProCard account their ProCard must be returned to Procurement Services, or safely shredded, and the ProCard Program Administrator notified.